In the realm of modern finance, Bitcoin has emerged as an evolutionary asset, captivating the attention of investors worldwide. Since its inception in 2009, Bitcoin has experienced significant price fluctuations, garnering both skepticism and enthusiasm. Despite the volatility, an increasing number of investors are recognizing the long-term benefits of owning Bitcoin as a strategic investment.

Resilience and Decentralization

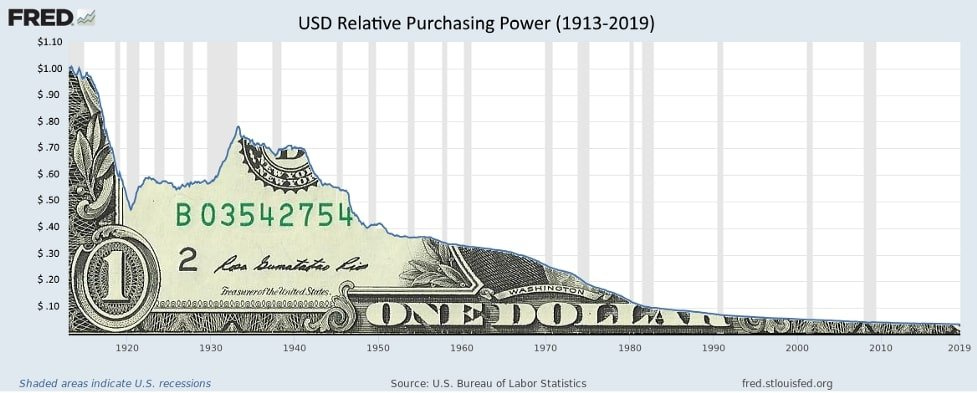

Bitcoin operates on a decentralized network, free from the control of any central authority. This decentralized nature makes it resilient to geopolitical turmoil, economic instability and inflationary pressures. Unlike traditional fiat currencies, which can be manipulated by governments and central banks, Bitcoin's finite supply of 21 million coins ensures protection against inflationary devaluation. As a result, Bitcoin serves as a hedge against currency devaluation and preserves purchasing power over the long term.

Store of Value

One of the most compelling arguments for Bitcoin as a long-term investment is its potential to serve as a store of value. Similar to gold, Bitcoin is often referred to as "digital gold" due to its scarcity and durability. As a non-correlated asset, Bitcoin offers diversification benefits within investment portfolios, reducing overall risk exposure. Institutional adoption and mainstream acceptance further solidify Bitcoin's status as a legitimate store of value, attracting long-term investors seeking wealth preservation and capital appreciation.

Growth Potential and Adoption

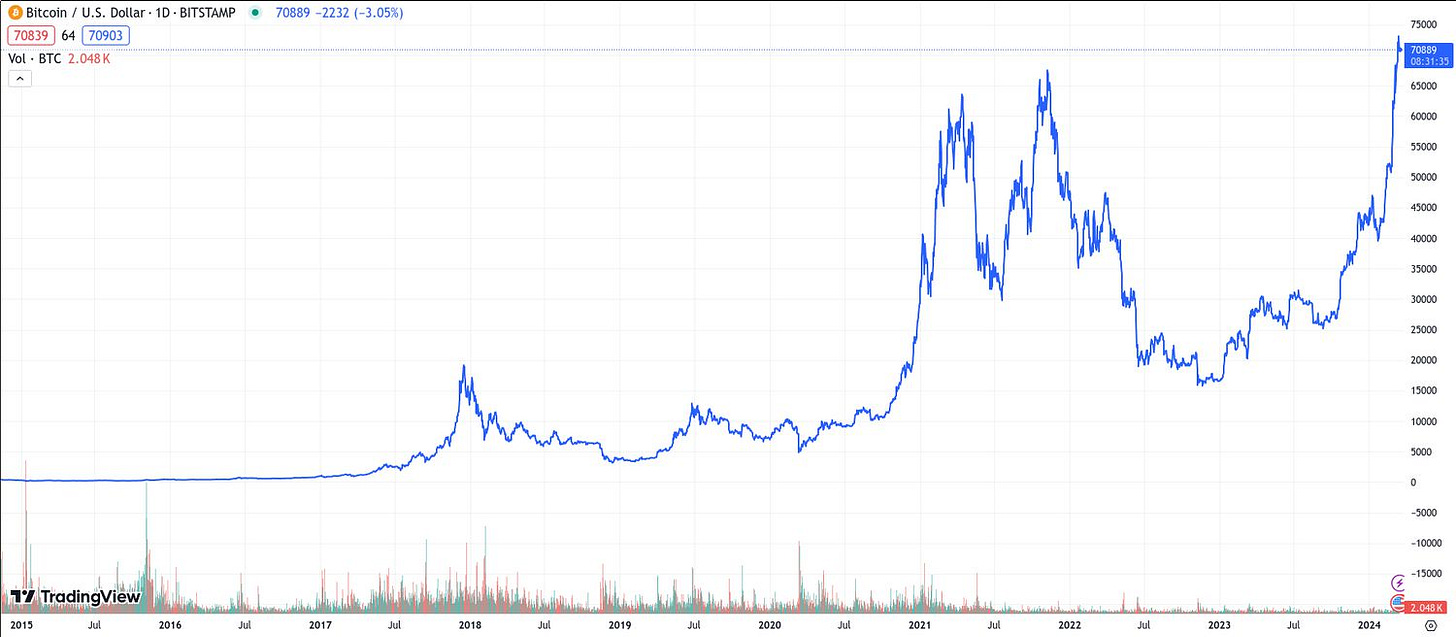

Bitcoin's exponential growth trajectory underscores its potential for substantial returns over the long term. Despite periodic price fluctuations, Bitcoin has consistently demonstrated an upward trend, outperforming traditional assets such as stocks, bonds and commodities. The increasing adoption of Bitcoin by institutional investors, corporations and payment processors signifies growing confidence in its legitimacy and utility. As Bitcoin's network effect continues to expand, its value proposition strengthens, fueling demand and driving price appreciation.

Technological Innovation

Beyond its monetary value, Bitcoin represents a groundbreaking technological innovation with far-reaching implications. The underlying blockchain technology enables secure, transparent and immutable transactions, revolutionizing various industries beyond finance. From supply chain management to voting systems, blockchain technology has the potential to streamline processes, enhance efficiency and mitigate fraud. As Bitcoin's ecosystem evolves and matures, the innovation it fosters could yield significant dividends for investors in the long run.

Financial Sovereignty and Accessibility

Owning Bitcoin empowers individuals with financial sovereignty, allowing them to transact and store wealth outside the confines of traditional financial institutions. With Bitcoin, users have full control over their funds, eliminating the need for intermediaries and reducing transaction costs. This accessibility is particularly beneficial for the unbanked and underbanked populations worldwide, providing them with an alternative means of accessing financial services and participating in the global economy.

In Summary

While Bitcoin's price volatility may deter some investors, those who recognize its long-term potential stand to reap substantial rewards. As a decentralized digital asset, Bitcoin offers resilience, store of value characteristics, growth potential, technological innovation and financial sovereignty. By incorporating Bitcoin into a diversified investment strategy, investors can hedge against inflation, diversify their portfolios, and position themselves for wealth accumulation in the digital age. As the adoption of Bitcoin continues to accelerate, its status as a long-term investment is increasingly attractive.

p.s. Don’t put all your eggs in one basket.

Enjoy and be safe.

Note: This is not financial advice. For information purposes only.