Let’s review Warren Buffet’s Rules:

Rule #1: Never Lose Money

This might seem like a joke or something witty, because who actually sets out to lose their hard-earned cash? Yet, investors don’t fully understand this critical rule.

Rule #2: Never Forget Rule No. 1

The mindset of a sensible investor must include the “math of investing” which takes us back to Rule #1. Understanding Drawdown Math is extremely critical if you want to compound your wealth. Don't gamble away your assets. Don't go into investments with a cavalier attitude that it's OK to take large losses. Do your homework and understand the simple math of drawdowns.

To Grow Your Wealth, You Must Protect It

A good analogy may be a farmer. A farmer must protect his crops so that he can grow them. He installs scarecrows to ward off birds from eating his freshly planted seeds. He puts up fencing to prevent rabbits and rodents from eating his crops. And he uses insecticide (hopefully organic) to deter insects from having a feast on his plants. Just like the farmer, we must protect our crops, in this case our assets, while we grow them. While there is no foolproof way to guarantee the safety of your wealth and in particular, your investment portfolio, there are several steps you can take to minimize risk and maximize the chances of successfully protecting it in order to grow it. Here are some tips on how to protect your investment portfolio:

Understand the mathematics of drawdowns:

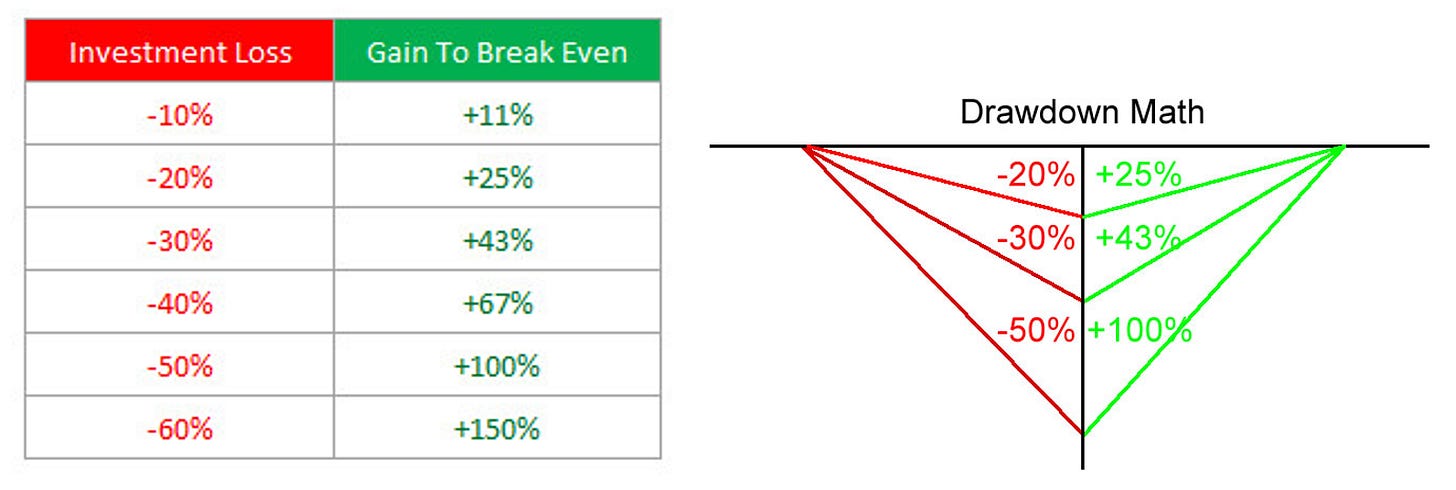

Consider the below charts. This is the ugly mathematics of drawdowns:

If you lose only -10%, not that big of a deal. You probably can make back the +11% needed to get to breakeven. However, once you start losing more, the math becomes very ugly. At a -20% loss, one needs earn back +25% to reach breakeven. At -30% loss, one needs to earn +43% to reach flat; at -50% loss, one needs +100%. Pause and think about that for a moment…you need to double what’s left of your portfolio just to get back to your original amount if you suffer a -50% drawdown. That’s why Buffet’s Rule #1 and Rule #2 are so important.

So how does one “Never Lose Money?” Very difficult, but one can potentially “lose smaller amounts of money” by incorporating certain concepts. Consider downside protective strategies: There are a number of strategies that can help protect your portfolio from downside risk, such as using stop-loss orders, buying put options or even going to cash. However, it is important to remember that these strategies can also limit your portfolio’s upside potential, but given the ugly math of drawdowns, they are worth consideration.

Enjoy and be safe.