Effective portfolio management is crucial for advanced investors aiming to maximize returns, manage risk, and achieve their financial goals. Leveraging the right software and tools can streamline the process, providing valuable insights, real-time data, and sophisticated analytics. This blog explores the best portfolio management software and tools available for advanced investors, highlighting their features, benefits, and how they can enhance investment strategies.

I. Importance of Portfolio Management Software

Definition and Explanation: Portfolio management software helps investors track, analyze, and optimize their investments. These tools offer features like performance tracking, risk assessment, asset allocation, and tax optimization.

Benefits:

Real-Time Data: Access to real-time market data and portfolio updates.

Advanced Analytics: Tools for in-depth analysis, including performance metrics, risk assessment, and scenario analysis.

Streamlined Management: Simplifies portfolio management by automating processes like rebalancing, tax-loss harvesting, and reporting.

Example: An investor uses portfolio management software to monitor their investments across various accounts, track performance metrics, and make informed decisions based on real-time data and advanced analytics.

II. Top Portfolio Management Software and Tools

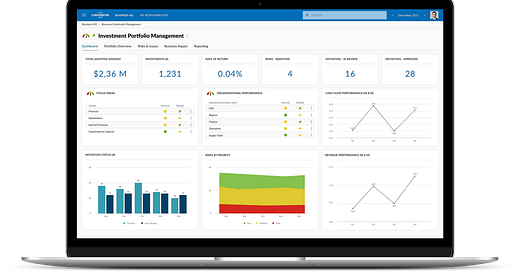

1. Personal Capital

Features:

Financial Dashboard: Comprehensive view of all financial accounts, including investments, bank accounts, and credit cards.

Investment Checkup: Analyzes portfolio performance, asset allocation, and fees.

Retirement Planner: Projects retirement readiness and suggests strategies to achieve retirement goals.

Benefits:

Holistic View: Consolidates all financial information in one place.

Free Tools: Offers a range of free tools for tracking and managing investments.

Professional Advisory Services: Provides access to financial advisors for personalized advice.

Example: An investor uses Personal Capital to track their investment accounts, analyze portfolio performance, and plan for retirement, benefiting from a comprehensive view of their finances and access to professional advice.

2. Morningstar Direct

Features:

Research and Analytics: Access to extensive research, data, and analytics on mutual funds, ETFs, and stocks.

Portfolio Analysis: Advanced tools for performance attribution, risk analysis, and scenario testing.

Investment Screener: Customizable screener to identify investment opportunities based on specific criteria.

Benefits:

In-Depth Research: Extensive database of financial data and research reports.

Customizable Tools: Tailor analysis and screening tools to fit individual investment strategies.

Professional-Grade Analytics: Advanced analytics for deep portfolio insights.

Example: An advanced investor uses Morningstar Direct to perform detailed research on potential investments, analyze portfolio performance, and identify opportunities for diversification and risk management.

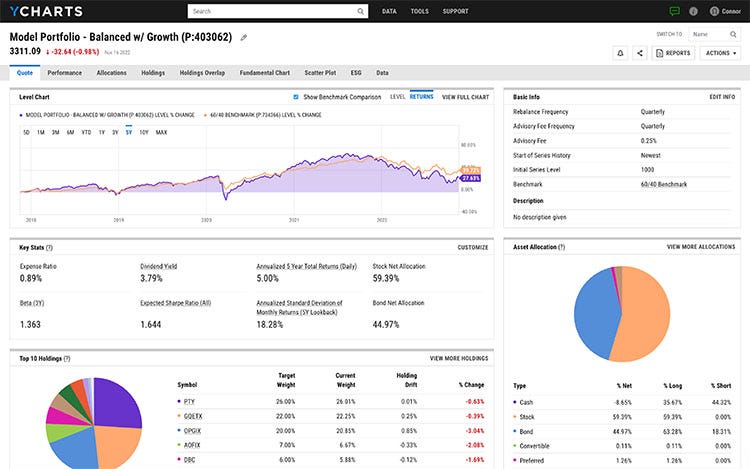

3. YCharts

Features:

Data Visualization: Interactive charts and graphs for visualizing financial data and trends.

Screening and Filtering: Customizable screeners to find investments that meet specific criteria.

Scenario Analysis: Tools for modeling different investment scenarios and stress testing portfolios.

Benefits:

Visual Insights: Easy-to-understand visualizations of complex financial data.

Customizable Analysis: Tailor screens and filters to fit specific investment strategies.

Scenario Planning: Model potential outcomes and assess portfolio resilience.

Example: An investor uses YCharts to visualize market trends, screen for high-performing stocks, and conduct scenario analysis to understand the potential impact of market changes on their portfolio.

4. Quicken Premier

Features:

Budgeting and Expense Tracking: Tools for managing personal finances, including budgeting and expense tracking.

Investment Tracking: Track investment performance, asset allocation, and portfolio value.

Tax Planning: Tools for managing tax-related tasks and optimizing tax efficiency.

Benefits:

Comprehensive Financial Management: Combines personal finance management with investment tracking.

User-Friendly Interface: Easy-to-use interface for managing finances and investments.

Tax Optimization: Tools for planning and optimizing taxes.

Example: An investor uses Quicken Premier to manage their household budget, track investment performance, and optimize tax planning, benefiting from an integrated approach to personal and investment finance.

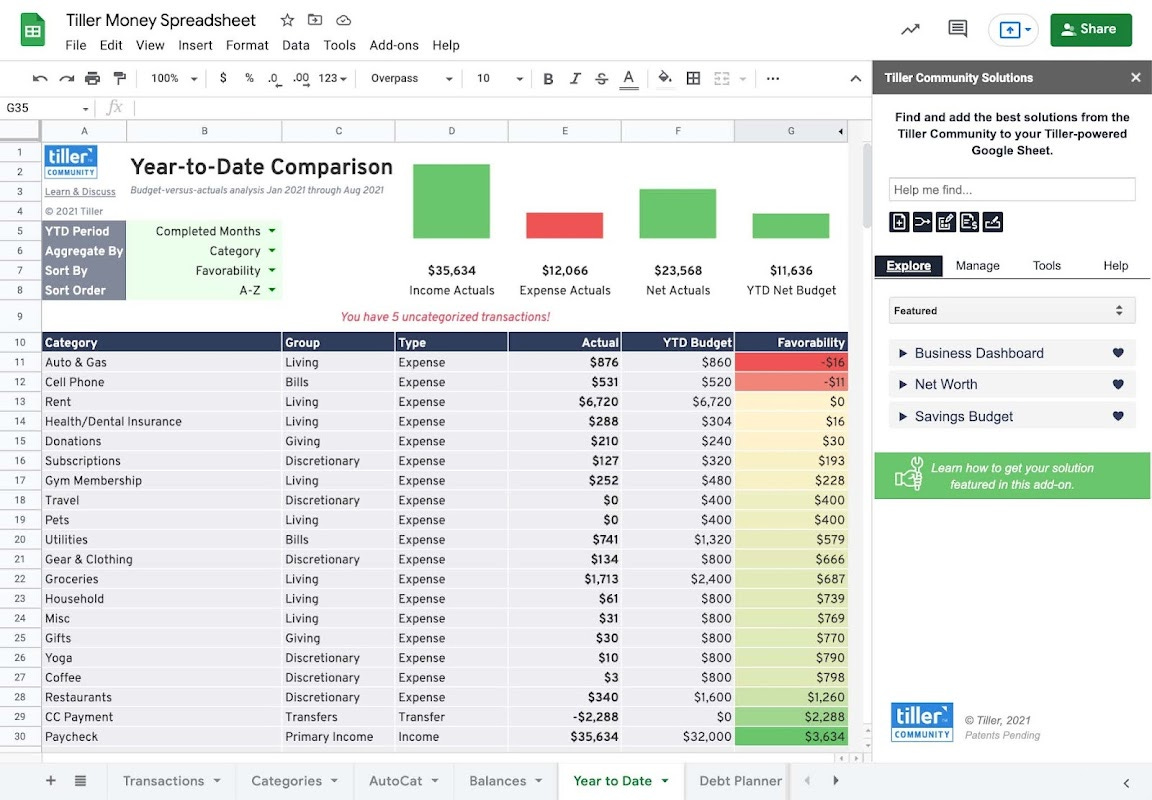

5. Tiller Money

Features:

Spreadsheet Integration: Automatically updates financial data in customizable Google Sheets or Excel templates.

Expense Tracking: Tools for tracking expenses and managing budgets.

Investment Tracking: Track investment performance and portfolio allocation.

Benefits:

Customizable Spreadsheets: Flexibility to create personalized financial management templates.

Automatic Updates: Real-time updates of financial data in spreadsheets.

Integration: Combines expense tracking and investment management in one place.

Example: An investor uses Tiller Money to create a customized spreadsheet for tracking their investment portfolio and household budget, benefiting from real-time updates and personalized financial management.

6. Interactive Brokers (IBKR) PortfolioAnalyst

Features:

Comprehensive Reporting: Generate detailed reports on portfolio performance, asset allocation, and risk metrics.

Benchmarking: Compare portfolio performance against various benchmarks.

Integration: Consolidate data from multiple accounts for a holistic view.

Benefits:

Detailed Analysis: In-depth reports on various aspects of portfolio performance.

Holistic View: Integration of data from multiple accounts and asset classes.

Benchmarking: Compare performance to relevant benchmarks for better insights.

Example: An advanced investor uses IBKR PortfolioAnalyst to consolidate data from multiple brokerage accounts, generate detailed performance reports, and benchmark their portfolio against market indices.

III. How to Choose the Right Portfolio Management Tool

Assess Your Needs:

Determine what features are most important based on your investment strategy, such as performance tracking, research, tax optimization, or scenario analysis.

Consider Cost:

Evaluate the cost of the software or tool, including subscription fees and any additional charges for premium features.

User Interface:

Ensure the tool has an intuitive and user-friendly interface that makes it easy to navigate and use.

Integration Capabilities:

Check if the tool can integrate with your existing financial accounts and other software you use for a seamless experience.

Example: An investor looking for detailed performance analysis and benchmarking may choose Interactive Brokers PortfolioAnalyst, while someone seeking a holistic financial view might opt for Personal Capital.

IV. Real-World Examples and Case Studies

Example 1: Comprehensive Financial Management with Personal Capital An investor uses Personal Capital to track all financial accounts, including investments, savings, and credit cards. The platform’s investment checkup tool helps them optimize their asset allocation and reduce fees, while the retirement planner projects their future financial readiness.

Example 2: In-Depth Research and Analysis with Morningstar Direct A fund manager uses Morningstar Direct to conduct detailed research on mutual funds and ETFs, analyze performance attribution, and perform scenario testing. This helps them make informed investment decisions and manage client portfolios effectively.

Example 3: Visualizing Market Trends with YCharts An investor leverages YCharts to create interactive charts and graphs, helping them visualize market trends and identify investment opportunities. The scenario analysis tool enables them to model potential market changes and adjust their portfolio accordingly.

V. Conclusion

Leveraging portfolio management software and tools is essential for advanced investors aiming to maximize returns and manage risks effectively. By utilizing the features and benefits of top tools like Personal Capital, Morningstar Direct, YCharts, Quicken Premier, Tiller Money, and Interactive Brokers PortfolioAnalyst, investors can gain valuable insights, streamline their investment process, and achieve their financial goals. Choosing the right tool based on individual needs and preferences will enhance portfolio management and contribute to long-term investment success.

VI. Additional Resources

Books:

"The Intelligent Investor" by Benjamin Graham

"A Random Walk Down Wall Street" by Burton G. Malkiel

Online Courses:

Coursera’s "Investment Management" by the University of Geneva

Udemy’s "The Complete Financial Analyst Training & Investing Course"

Websites and Forums:

Investopedia: Comprehensive articles on portfolio management and investment strategies

Bogleheads Forum: Community discussions on investing and portfolio management

Further Reading:

Research papers and reports on advanced portfolio management techniques

Financial news outlets for the latest trends and developments in investment management

By leveraging these resources, advanced investors can deepen their understanding of portfolio management strategies and effectively utilize the best software and tools available to optimize their investment outcomes.

Enjoy and be safe.