Concentrated stock portfolios, characterized by a significant allocation to a limited number of individual stocks, offer both potential rewards and inherent risks. Let’s explore the advantages and pitfalls of concentrated stock holdings, drawing insights from industry experts and real-world examples to illustrate the complexities of this investment approach.

The Benefits of Concentrated Stock Portfolios:

1. Potential for High Returns:

Concentrated portfolios have the potential to deliver outsized returns, especially when investors identify undervalued or high-growth companies. Warren Buffett, renowned for his concentrated approach through Berkshire Hathaway, famously stated, "Diversification is protection against ignorance. It makes little sense if you know what you're doing." Successful investors like Buffett have demonstrated the efficacy of concentrated bets in generating substantial wealth over the long term.

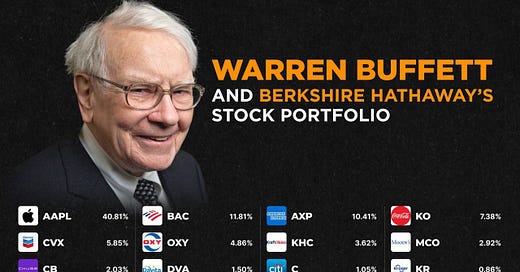

How concentrated is Warren Buffett’s stock portfolio?

Top 4 holdings = 70.4%

Top 8 holdings = 88.7%

Top 12 holdings = a whopping 94.1%

2. Enhanced Focus and Conviction:

A concentrated portfolio allows investors to maintain a sharper focus on their best ideas, fostering a higher level of conviction in their investment thesis. This concentrated approach encourages in-depth research and active monitoring of portfolio holdings, leading to better-informed investment decisions. As Peter Lynch, former manager of Fidelity Magellan Fund, observed, "In the short run, the market is a voting machine, but in the long run, it is a weighing machine." Concentrated investors prioritize the intrinsic value of individual companies over short-term market fluctuations.

3. Simplified Portfolio Management:

Managing a concentrated portfolio can be less cumbersome compared to a diversified one, as it requires monitoring a smaller number of holdings. This simplicity allows investors to react more swiftly to market developments and capitalize on emerging opportunities. Moreover, concentrated portfolios may incur lower transaction costs and administrative burdens associated with maintaining a broad array of investments.

The Risks and Challenges of Concentrated Stock Portfolios:

1. Increased Volatility and Risk Exposure:

Concentration amplifies the impact of individual stock performance on portfolio returns, heightening volatility and risk exposure. A significant decline in the value of a single stock can have a disproportionate effect on the overall portfolio, potentially leading to substantial losses. This risk is exemplified by the downfall of once high-flying stocks like Enron and WorldCom, which caused significant losses for concentrated investors who failed to diversify.

2. Lack of Diversification:

Concentrated portfolios lack the risk-reducing benefits of diversification, leaving investors vulnerable to idiosyncratic risks specific to individual companies or sectors. A single adverse event, such as a regulatory setback or competitive threat, can severely impact the portfolio's performance. Even successful companies can face unexpected challenges, as evidenced by the struggles of some recent companies in adapting to changing market dynamics.

3. Overconfidence and Cognitive Biases:

Investors in concentrated portfolios may succumb to overconfidence and cognitive biases, leading to suboptimal decision-making. Confirmation bias, anchoring, and herding behavior can distort perceptions of risk and reward, potentially leading to excessive risk-taking or reluctance to sell underperforming positions. Behavioral finance research highlights the importance of guarding against these biases and maintaining discipline in portfolio management.

Concentrated stock portfolios offer the allure of potential riches for savvy investors who can identify and capitalize on market inefficiencies. However, this investment approach comes with inherent risks that demand careful consideration and prudent risk management. While concentrated portfolios can yield exceptional returns in the right hands, they require a deep understanding of individual companies, rigorous research, and a steadfast commitment to disciplined investing principles. By striking a balance between opportunity and risk, investors can navigate the complexities of concentrated stock portfolios and pursue their financial goals with confidence and resilience.

Enjoy and be safe.