Emerging markets offer retail investors significant growth opportunities, often outpacing those found in developed markets. These regions, characterized by rapid economic development and industrialization, can provide high returns. However, investing in emerging markets also comes with unique risks and challenges. This blog explores advanced strategies for navigating emerging markets, understanding the associated risks, and optimizing your investment portfolio for growth.

I. Understanding Emerging Markets

Definition and Explanation: Emerging markets are nations experiencing rapid industrialization, economic growth, and development. They are in transition from developing to developed status and typically have higher growth rates than mature economies.

Characteristics:

High Growth Potential: Emerging markets often exhibit strong economic growth, driven by industrialization, urbanization, and increasing consumer demand.

Young and Growing Populations: These markets typically have younger, growing populations, which can drive future economic expansion.

Increasing Foreign Investment: Emerging markets attract significant foreign direct investment (FDI) due to their growth prospects and investment opportunities.

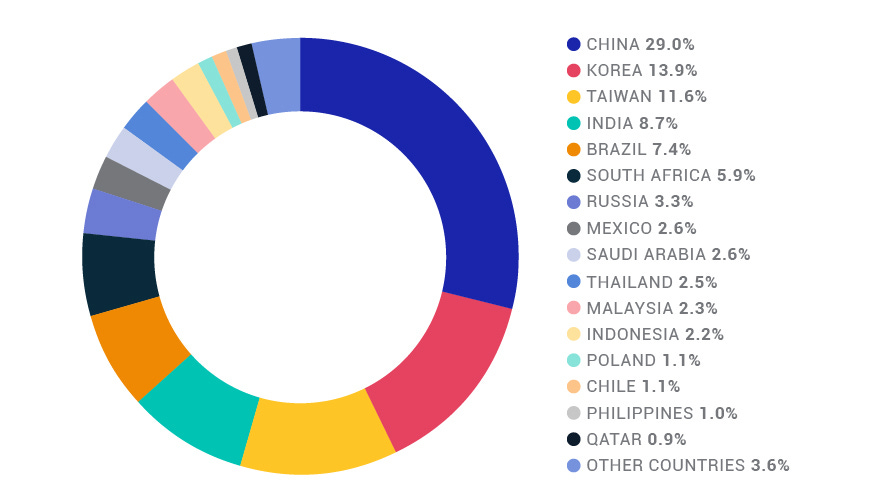

Examples of Emerging Markets:

BRICS: Brazil, Russia, India, China, and South Africa.

MINT: Mexico, Indonesia, Nigeria, and Turkey.

Other Notable Markets: Vietnam, Philippines, Malaysia, and Poland.

Example: An investor seeks to capitalize on the growth potential of India, an emerging market with a rapidly expanding middle class and significant infrastructure development. They research opportunities in sectors such as technology, consumer goods, and real estate.

II. Benefits of Investing in Emerging Markets

High Growth Potential: Emerging markets often experience higher economic growth rates compared to developed markets, providing investors with the potential for significant capital appreciation.

Diversification: Including emerging markets in your investment portfolio can enhance diversification, as these markets often have different economic cycles and growth drivers compared to developed economies.

Undervalued Opportunities: Emerging markets can offer undervalued investment opportunities, as these regions may be overlooked or underrepresented in global investment portfolios.

Example: An investor diversifies their portfolio by allocating a portion to emerging markets ETFs, capturing growth opportunities in countries like China and Brazil while reducing overall portfolio risk.

III. Risks and Challenges of Investing in Emerging Markets

Political and Economic Instability: Emerging markets can be more susceptible to political instability, economic volatility, and regulatory changes, which can impact investment performance.

Currency Risk: Investing in emerging markets exposes investors to currency risk, as fluctuations in exchange rates can affect returns.

Market Liquidity: Emerging markets may have lower market liquidity, making it more challenging to buy and sell investments without impacting prices.

Example: An investor faces currency risk when investing in a Brazilian company, as fluctuations in the Brazilian real against their home currency can impact their overall returns.

IV. Advanced Strategies for Investing in Emerging Markets

1. Diversify Across Regions and Sectors:

Region Diversification: Invest in multiple emerging markets to spread risk and capture growth opportunities in different regions.

Sector Diversification: Allocate investments across various sectors, such as technology, healthcare, consumer goods, and infrastructure, to mitigate sector-specific risks.

Example: An investor builds a diversified portfolio with exposure to technology companies in China, healthcare firms in India, and consumer goods manufacturers in Mexico, reducing regional and sector-specific risks.

2. Use Exchange-Traded Funds (ETFs) and Mutual Funds:

ETFs: Emerging markets ETFs provide diversified exposure to a basket of stocks from various emerging markets, offering a convenient way to invest in these regions.

Mutual Funds: Emerging markets mutual funds offer professional management and diversification across multiple countries and sectors.

Example: An investor buys shares in an emerging markets ETF that tracks a broad index of companies from multiple emerging markets, gaining diversified exposure to these regions with a single investment.

3. Focus on High-Growth Sectors:

Identify and invest in high-growth sectors within emerging markets, such as technology, renewable energy, and healthcare, which are often at the forefront of economic development.

Example: An investor targets high-growth sectors in emerging markets by investing in a renewable energy company in India and a technology firm in Vietnam, capitalizing on the rapid development in these industries.

4. Consider Frontier Markets:

Frontier markets are smaller, less developed economies with significant growth potential. These markets can offer higher returns but also come with increased risks.

Example: An investor allocates a small portion of their portfolio to frontier markets like Kenya and Bangladesh, seeking higher returns while being aware of the elevated risks.

5. Monitor Economic Indicators and Political Developments:

Stay informed about economic indicators, such as GDP growth, inflation rates, and political developments, to make informed investment decisions and manage risks effectively.

Example: An investor closely monitors economic data and political news in South Africa to make timely investment decisions and adjust their portfolio based on changing conditions.

V. Risk Management and Due Diligence

Conduct Thorough Research:

Investigate the economic, political, and regulatory environment of the target emerging market.

Evaluate the financial health and growth prospects of companies within these markets.

Diversify Investments:

Spread investments across different regions, sectors, and asset classes to reduce risk.

Hedge Currency Risk:

Use currency hedging strategies to mitigate the impact of exchange rate fluctuations on your investments.

Seek Professional Advice:

Consult with financial advisors and experts specializing in emerging markets to make informed decisions and manage risks effectively.

Example: An investor conducts thorough research on the economic outlook and political stability of Indonesia before investing in a local consumer goods company. They also hedge against currency risk by using currency futures contracts.

VI. Real-World Examples and Case Studies

Example 1: Successful Investment in China's Technology Sector An investor identifies the rapid growth of China's technology sector and invests in a leading Chinese e-commerce company. The company's strong performance and expansion into new markets result in substantial returns for the investor.

Example 2: Diversified Emerging Markets Portfolio An investor builds a diversified portfolio with exposure to various emerging markets, including Brazil, India, and South Africa. By investing in ETFs and mutual funds, the investor captures growth opportunities while managing risks through diversification.

Example 3: Frontier Market Investment in Kenya An investor allocates a portion of their portfolio to a Kenyan infrastructure project, seeking high returns from the country's economic development. The project succeeds, providing the investor with significant capital appreciation.

VII. Wrapping it up

Investing in emerging markets offers retail investors the potential for high returns and portfolio diversification. By understanding the benefits, risks, and advanced strategies for navigating these markets, investors can make informed decisions and optimize their portfolios for growth. Conducting thorough research, diversifying investments, and staying informed about economic and political developments are crucial for successful emerging market investments.

VIII. Additional Resources

Books:

"The Little Book of Emerging Markets: How to Make Money in the World's Fastest Growing Markets" by Mark Mobius

"Breakout Nations: In Pursuit of the Next Economic Miracles" by Ruchir Sharma

Online Courses:

Coursera's "Emerging Markets: Understanding and Strategies"

Udemy's "Investing in Emerging Markets: The Growth Engines of the Future"

Websites and Forums:

MSCI: Indexes and insights on emerging markets

The Economist: Coverage of global economic and political developments

Further Reading:

Academic journals and research papers on emerging market investment strategies

Financial news outlets for the latest developments in emerging markets

By leveraging these resources, retail investors can deepen their understanding of emerging markets and effectively incorporate advanced strategies into their investment practices.

Enjoy and be safe.